This might be duh for some people, but if you’re like me and considering a mortgage; at today’s rates in the US at around 5-6%, over 30yr mortgage you will pay about same in interest as you will for your house price.

Your $500k house will cost you around $1M total over thirty years.

I was surprised.

You might also be surprised to know that increasing your payments a little can shave off a lot of interest. Paying 10% extra on your payments saves you about $100k of interest on your $500k loan at 5%, and pays it off about 5 years earlier.

Anything above and beyond the monthly payment can go towards the principal, which is an especially big deal at the start of the mortgage. But be sure to verify that the bank is actually applying it all to the principal as you intend.

https://www.sharonview.org/resources/tools-education/financial-calculators/mortgage-payoff

This tool makes it easy to figure out how much overpayment will save over the life of a mortgage/loan.

Unless you have offset accounts, in which case it’s better to hold surplus liquid that offsets the amount owing before interest calculation

That works, but I don’t know if “better” is the right word. If you have the same amount offset or paid off, it’s the same outcome. The only difference is if you offset then you can spend it - for better or for worse.

You could also bump your payments up and use an offset account for any extra.

Offset is generally considered better because if you have an emergency or financial opportunity you still have access to cash. If you put extra into repayments you’re forced to redraw or refinance if you suddenly need funds.

Be careful with this type of math. Avoiding interest shouldn’t be the primary goal, increasing your net worth should be.

For example, let’s say you put down 20% on a $500k 5.5% loan (so $100k down), your payment would be ~$2300. Let’s say rent is $2000 for a big enough place, and rent increases by 4% as well. Let’s also assume your real estate increases in value by 4% per year. Let’s also assume you invest the difference and get 10% returns over that 30 year mortgage. Here’s what you’d be left with according to my spreadsheet (I’m happy to share if requested):

- mortgage - $1,621,698.76 home value

- rent + invest - $2,053,133.37 investment value

If you put 5% down, your payment will be even higher, but the down payment will be lower, so the house comes out slightly ahead with the rent option becoming $1,527,938.55. But you’ll note that I didn’t add in property taxes, closing costs, repairs, etc, so renting will probably still come out ahead.

That said, this isn’t an apples to apples comparison, and there are a lot of other factors to consider, such as:

- quality of life - not sharing a wall, more property, etc

- permanently reduces living expenses once paid off

- option to refinance to a lower rate

- capital gains exclusion on primary residence (at least in the US)

In some areas, renting is strictly superior (esp. in urban areas), and in others, owning is strictly superior (with the caveat that you’ll stay put for a time).

Just looking at one factor like interest paid, rent “wasted,” etc won’t tell the whole story, though it can be fun.

Edit: I messed up my calculations because my spreadsheet wasn’t increasing rent properly. This brought renting lower than buying, so I adjusted my calculations to include house maintenance costs (web resources claim 1-4% of home value/year), but still not add in insurance, taxes, etc. This made the numbers very similar, w/ rent + invest being $2,025,801.00 for 20% down and $1,500,606.19 for 5% down. Here’s the webpage w/ the spreadsheet, and here’s the LibreOffice compatible file.

One solarpunk consideration that factored into my desire to buy a house is the ability to put in solar, passive underground heat collection, rainwater collection, and high-cost luxury perennials like fruit trees and berry bushes. These add about $700 of value to me a month, with startup costs breaking even within a few years. It’s not fully replacing any category, just taking the edge off. I was unable to do any of these in a tiny apartment. I could comfortably reduce my consumption to nearly fully replace heat, water, and power. Food is the hard one.

There’s something very powerful about knowing you are producing something real on your land. I’m not a nut about it, just like to see my property using the sun and rain.

Oh absolutely, and I bought a house for largely that reason. I also DIY most of my repairs, so according to my math, I should come out ahead vs renting, and enjoy more space and more freedom to do what I please on that property (no HOA, so very few rules on what I can do). But a lot of people end up spending more on a house vs renting because:

- they buy more house than they need

- they fill up unused space w/ stuff (RV that gets used maybe once a year, beds in unused rooms, etc)

- they hire out repairs to experts (call plumber for every clog, have a lawn service, etc)

- constantly upgrade things, and again, hire out the help to do it (often getting a HELOC or something to fund it)

My area has low property taxes, relatively low house insurance, and my dad taught me how to do a lot of basic things around the house (i.e. I repair my car in my garage, I do basic electrical work like swapping plugs and switches, have fixed my appliances a few times, etc).

There are absolutely ways to profit off owning property, but there are also a lot of ways to piss that away. That’s why I use national averages for things like this, not my own experience.

This is the kind of shit that has fucked the economy and home ownership.

Which part?

This is the classic rent vs buy math, and it’s always been pretty close (see this video). Renting is better if you’ll end up paying people to do the maintenance for you, and buying is better if you’ll DIY most of the repairs. The math is also very location and lifestyle dependent, where the closer to downtown you live or the more frequently you’ll move, the better you’ll be off renting; likewise, generally speaking, the further from downtown you live or the less likely you are to move, the better off you are buying.

I bought a place, because the math in my area and for my lifestyle worked out. Ben Felix (the guy in that video) decided to rent, because the math for his area and his lifestyle worked out. Both options work.

The part where a basic human need is commodified for financial gain and the normalization of it all.

That’s a completely separate discussion though. We make financial decisions based on how things are, and political decisions based on how we think they should be.

While I agree that it should be more affordable and our system is broken, I don’t think it’s a bad idea to work within the system to see what works out as the best long term option for being better off, from a purely financial perspective. Then the security and emotional side can be considered perspective. More financial literacy, not less is what leads to changing the system. When people don’t understand the system, they don’t have the same level of political support for changes that can actually work.

I don’t care about my net worth, I want to live and touch grass while working as little as possible. How do I optimise for that instead?

Go back to respec and pick boomer as your birth generation. The earlier the better, since all of the good level up perks were patched out for later players. Also, try to roll for high family wealth, otherwise there’s a good chance you end up in the same place all over again.

That’s fine. This exercise merely helps figure out how to get there most efficiently. If you want to maximize the time you spend not working, you’ll want your money to be working for you as soon as possible.

If I understand “touch grass” as “do inexpensive, enjoyable activities” like hiking, going to the park, etc, then I recommend (assuming you’re starting just out of college):

- rent a place close to your work to minimize commute time - don’t buy, since that comes w/ time spent on maintenance

- get a good paying job that respects your time - dollars per hour are the most important, not total dollars - this is the hardest part

- cut expenses to the bone aggressively to save every penny - after all, the goal isn’t to buy fancy things, but touch grass

Then once you get $100k or so invested, switch to a lower paying job that you enjoy or takes minimal time, while meeting your basic needs (example: part-time barista job that provides benefits), and let that $100k compound. if you can reach that point by 40, that $100k should grow to $1M by 65, at which point you can probably take Social Security or whatever similar program your country has. In the US, you should be able to get $2k/month or so (today’s dollars), and that $1M should provide $40k/year (~$3k/month; future dollars), which in today’s dollars would be something like $3k/month, which is a solid $36k/year (plenty of people live on that). If you wait until you’re 70, SS would increase a bit (perhaps $2.5-3k/month) and your investments would grow a bit (provide about 70% more income), so you’d end up at $4-4.5k/month, which is very solid.

If you’re comfortable moving to a less expensive place (assuming you live someplace like Europe or the US), you could retire much earlier.

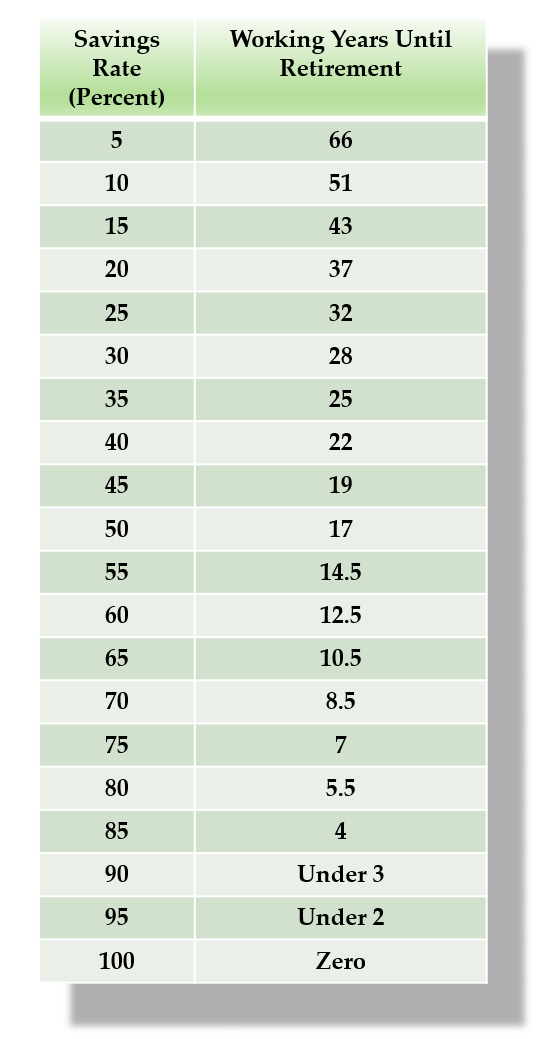

Actually that does remind me of a chart I saw about income/cost of living and at a certain point it means you can retire very quickly. The less money you need, the faster you can retire.

Pretty sure a lot of my savings comes down to not driving, cars cost a lot and that is a large part of why I didn’t learn to drive. I didn’t have £1000s to spend when I was 17 so I used my bike instead. I am in my 30s now and the only difference is that I finally bought a new bike a couple of years ago. I could afford to now if I desperately wanted to, but I just feel indifferent towards it and I am not spending thousands on something I feel indifferent to.

Might it have been this one?

Setting aside critiques of Mr Money Mustache, this is grounded in hard math and is the result of “having enough”. In the developed world, “having enough” is easier than ever, yet the culture insists on trying to achieve even more, having more money, more house, more children, etc. Whereas the general notions of evaluating what brings value or happiness (see Marie Kondo: “ask yourself if it sparks joy”) is more in like with “working to live, rather than living to work”.

There’s an equivalent maxim in vehicle engineering to that chart, something along the lines of “lightness begats lightness”, and refers to how shaving off weight from an automobile allows reducing the engine power or the brake size, which further allows weight reductions, etc. The eventual result is having only the essentials in places that matter (eg unsprung weight, rotational mass) in an optimized harmony. Personal finance can follow the same maxim.

“Perfection is achieved, not when there is nothing more to add, but when there is nothing left to take away” (usually ascribed to Antoine de Saint-Exupery)

Yeah that looks like it. The largest expenses I have is housing and tax which are like 5x everything else combined. Housing would be gone if the mortgage is paid off, though a lot of the tax remains as only income tax would be reduced by working less and the other taxes all remain the same.

Yeah, figuring out what you need and what you can live without can make decisions very empowering.

The other poster mentioned the FIRE chart by MMM, so I’ll take another angle on it. This site shows areas by cost of living. If you know how to estimate income generation from investments (~3% is a good rule of thumb before retirement age, 4% thereafter), you can find a place you can retire to if you have a few hundred thousand dollars/euros. If you’re fine with a BR apartment, there are options as low as $600/month ($180-240k investments).

What I mentioned is called “Batista FI”, so called because some parttime barista jobs provide medical benefits for even part-time work in the US. The idea is you save enough that you can live comfortably on part-time income and still meet your longer term retirement goals.

My point is the lower your expectations are for retirement, the earlier you can get there. And knowing you can retire can make working more pleasant because it’s a choice instead of a necessity.

Oh good point about the medical benefits if you are in the US, I live in the UK so that isn’t something you need to think about.

Yeah, if you have healthcare covered one way or another, then you just need enough to pay the bills if you have enough savings to grow into a retirement nest egg.

Dangerous assumptions.

invest the difference and get 10% returns over that 30 year mortgage.

whether you mean 15.5% ROI or 10%, when you simply assume either you should mortgage your children’s kidneys at 9% and it magically pays off.

real estate increases in value by 4% per year

Historically 3% is long term appreciation rate. Due to closing costs you generally need to stay 5 years in a home to break even. There is significant danger in western housing markets, where in US, high interest rates are making few people give up their precovid mortgage and there is low supply, and few new buyers at high price levels. Insurance rates are skyrocketing, and its better than 50/50 that tariffs will bump inflation and interest rates soon enough, and reduce affordability even more. Population will decline with deportations and fleeing of shithole country. In colonies, rulers gaslighting their people into austerity to fund 5% of GDP on US force amplification, while US destroys their economies, is likely to reduce employment and quality of life that gives homes value.

Rents are declining at the moment in the west. Being defensive with rent+investment strategy can mean more affordable housing later.

whether you mean 15.5% ROI or 10%, when you simply assume either you should mortgage your children’s kidneys at 9% and it magically pays off.

I mean the historical average for investment returns in a broad index. Basically, if you invest in the S&P 500 or something like the global world index, you should get about 10% returns before taking inflation into account (inflation adjusted is something like 7%).

Historically 3% is long term appreciation rate

I got 4% from this article:

U.S. homes typically gain 3% to 5% value each year.

And I ignored the breakeven point at 5%, because I assumed you wouldn’t move at all in that time. If you move in that time, you’ll have to pay that closing cost again, which impacts the estimate here in favor of renting. People seem to move once every 10 years or so, so add 2-5% closing costs each time you move, which would be a drag on wealth accumulation.

few people give up their precovid mortgage and there is low supply

I think there’s more to this as well. I haven’t verified this yet, so take it w/ a grain of salt, but my coworker (who is looking to buy) told me there have been a ton of foreclosures that banks just haven’t put on the market to prevent flooding the market (and reducing value). So it’s not just people holding onto old houses, but also banks holding onto foreclosed-on houses at comparable levels to 2008 (coworker claims it’s more). Definitely look up a source on that before making decisions based on that, but that’s the anecdote I’ve heard.

Population will decline with deportations

I highly doubt that’ll be a significant impact here. Let’s say we deport 500k people, that’s under 1% of the population. I’m guessing if we looked into the demographics here (poor brown people), the impact on housing would be even less (i.e. my brown coworker houses their mom and sister, who would probably live separately if they were more wealthy).

reduce employment

We are seeing a reduction in job creation, and it’s unclear how much of that is related to whatever is going on in the White House (I think it’s significant, but I don’t have data outside “tariffs and deportations bad”). The net result is we’re likely to see borrowing rates get cut due to fed rate cuts, which should make buying houses more attractive and is intended to encourage businesses to create jobs. We’ll see if that works.

Rents are declining at the moment in the west.

Yes, they’re coming off a peak because new construction has caught up w/ demand. House prices are also coming off peak, again, because new construction has caught up w/ demand.

I don’t understand how the investments from renting are so high at the end. Can you show your maths?

After a few years rent will be more than the mortgage payments, so there is nothing extra to invest. The person with the mortgage can now offset to save interest or invest the difference from renting.

They must live in a magic house with taxes that never go up and no major maintenance.

and a magic apartment with infinite rent control

Here’s the spreadsheet I used (web version w/o formulas; LibreOffice native format w/ formulas. This exercise was motivated by this video by Ben Felix.

It looks like I was calculating rent increase incorrectly (only increased one year), so I fixed that and the total was below the house value. However, I also wasn’t accounting for maintenance, so I added that in at 1% of house value per year (this article claims 1-4% per year, and the numbers are about what they were in my original post.

Here my calculation for investments while renting (I’m using monthly compounding):

FV(10%/12,12,(mortgage - rent)+(house maintenance/12),investment value)Investment value starts at the down payment, and otherwise we’re investing the difference between the mortgage and rent as well as how much the home owner would be paying for maintenance. There are still some things not being accounted for, like renter’s insurance, home insurance, taxes, etc, but I think those would favor renting as well, so I left it to a configurable percentage of the house value. You can play w/ the spreadsheet by using a fixed value (i.e. if you’re into DIY), adjusting the percent, changing borrowing rates, etc.

I compared my calculations w/ this investment calculator to make sure I did things correctly.

Seems like you have an outcome in mind and decide to adjust the figures to meet it, rather than reflect the reality.

I don’t disagree that it can be better for some to rent depending on the market and personal reasons. However, you also leave out all the associated costs with moving when renting. It is quite common to have to move, and purchase appropriate furniture, ever 2 years or so. You also have the home value appreciation much lower than historical or current and the investment returns higher than norms.

It may not be a conscious decision, but affects the figures greatly when compounding.

you have an outcome in mind and decide to adjust the figures to meet it, rather than reflect the reality.

More that I’m reproducing convincing evidence in a form that I understand and that I think I can communicate effectively in a comment.

My point is that you don’t need to own a house to retire or be successful financially. Your choice of rent vs buy is far less important than other decisions you could make. “Throwing money away” on rent or mortgage interest is missing the mark, and both are symptoms of not understanding finances.

quite common to have to move, and purchase appropriate furniture, ever 2 years or so

I also didn’t list home insurance or taxes, which in my area comes to ~$4k/year (and we’re on the lower end). That’s enough to cover the moving expenses if you pay someone to move you every 2-3 years. However, I’ve also known people who stayed in the same apartment for over a decade.

I tried to account for the biggest factors and keep things simple to prove the point that it’s closer than most probably assume.

You also have the home value appreciation much lower than historical or current and the investment returns higher than norms

I thought they were pretty reasonable. This article cites 3-5% for home appreciation, and this article cites over 10% for the State&Pepper 500 since 1957 and just shy of 10% going back to 1928. My numbers don’t account for inflation, which is why I added inflation to rent.

deleted by creator

At least at the end of the mortgage you will have a house. If you’re renting you’ll be paying pretty close to the same amount but won’t have anything to show for it. And then consider that a house will usually appreciate in value over that initial $500k after 30 years.

You might have a house at the end of the mortgage. You’ll definitely have the land, but the house and its paint only grow older, its plumbing and utilities more dated, and its interior design antiquated. Upkeep of an owner-occupied home comes with a lot of “weekend projects” that would otherwise be the responsibility of the landlord when renting. For those able and willing, that’s fine. But it’s not for everyone, and all should enter homeownership fully informed.

To be clear, I do think homeowner should be a realistic prospect for most people, but the notion that paying rent is equivalent to throwing it down the drain requires falsely assuming that one’s time is low-value, that homes aren’t depreciating assets, and that all land becomes more desirable and thus appreciates over time. Many communities in the Rust Belt, USA demonstrate the latter point.

If you’re renting you’ll be paying pretty close to the same amount but won’t have anything to show for it.

You also won’t have had to maintain a house or pay property taxes. I sold mine and rent now because I found ownership to be a PITA. YMMV.

Compared to renting, you pay substantially more when you own. Maintenance, repairs, insurance, property taxes, full utilities. Mortgage is just the base you pay.

At the end of the day, sure you own the house, but all those extra expenses don’t go away. Lately I have been seeing retired home owners selling because they can’t afford all the upkeep so they end up moving into a smaller unit.

Decades ago buying was a no brainer, but do you really think houses will continue to appreciate at this rate? Will a 2 bedroom run down bungalow really be worth 2 or 3 million in 10 years? At least with renting you can invest that money you save from not buying and get a guaranteed return.

For the record, I’m not saying not to buy, but you should not just buy because you think it is a good financial decision. It might not end up being the case depending on where you live

I pay less, but I also got a 3% mortgage. Though, if you include things I purchased because I wanted them: smoker, pavillion, garden, etc then I’ve paid much more. Some things raise the equity of the house, others don’t.

Yes, this is how interest works and how lenders make money. It’s a lot.

The lessons are:

Pay a little bit more every month (applied to principal) to the effect of 1 additional monthly payment a year or more. It will dramatically reduce your overall interest and length of loan.

You’re talking about a long loan, during that time rates will rise and fall. When they fall, you refinance at a lower rate. Don’t extend your loan longer (don’t take another 30 year loan after you’ve lived there 5 years, take a 25 year loan). That will give you the best market results for something you can’t control.

Look at the terms of your loan and your average return on your portfolio before blindly paying your mortgage early. If you manage to refinance at a good interest rate, you can often make more money on the market than you save on your mortgage. If I applied the balance of my savings to my principal today, I would lose significantly more interest from my investments than I’ll pay in interest to my bank over the life of my loan.

Glad you mentioned that, I completely forgot to bring that up.

You may be surprised that the average 30 year mortgage lasts fewer than 10 years due to being refinanced or paid off like in the event of a home sale. That’s why people use the 10 year yield for comparison.

When I bought my house in 2015, they told me 7 years was their assumption when you buy points. I bought the points thinking 3.25% for 30 was as good as it gets. Six years later I refinanced at 2.75 for 20, basically knocking 4 years of the end with the same payment.

Yeah, that’s how interest on debt works. It works the same way on your savings account, where the bank is essentially borrowing money from you at x% interest.

It’s actually worse in the case of mortgages because they’re front-loaded with interest, which will eat into your profits if you sell the house early.

It’s such a fucking scam that you pay the interest up front.

If you default on your house, the bank got a lot of money in interest and they get to keep the house.

I found a pretty interesting calculator that takes a lot of factors into account for buying vs renting. It’s for Canada, but you could modify a bunch of the parameters to get an idea for your area.

Hey, it’s another one of those things christians ignore about their bible.

And if you lend to those from whom you hope to receive back, what credit is that to you? For even sinners lend to sinners to receive as much back. But love your enemies, do good, and lend, hoping for nothing in return; and your reward will be great, and you will be sons of the Most High. - Luke 6:34-35

That’s taken out of context. The context is that Jesus is asking the disciples to follow him and distinguish themselves from others.

From verses 32-33:

32 “If you love those who love you, what credit is that to you? Even sinners love those who love them.

33 And if you do good to those who are good to you, what credit is that to you? Even sinners do that.

He doesn’t seem to say it’s bad to love those who love you or do good to those who do good to you, he’s just saying it’s not special. Likewise, I don’t think he’s saying it’s bad to charge interest for a loan, it just doesn’t set you apart from the rest.

If you want to be even better, love those that hate you, do good to those that harm you, and give without expecting anything in return. That will set you apart from the rest.

Usury (charging interest) was illegal for Jews, and if Jesus intended for it to be illegal for his followers, he would’ve made that clear. Instead, he’s merely saying that interest is a normal thing, and if you want to be extraordinary, you won’t charge it.

Now ask yourself, who is getting that money you paid in interest?

Whichever bank is holding your debt as their asset. Which isn’t necessarily the bank that originally underwrote the mortgage, because they may sell it to some other bank.

I got notice that Freddie Mac had bought mine from quicken before my first payment

Yeah, when you’re closing on a house, your attorney (if the state you’re in requires one, or you opt to hire one) will walk you through the payment schedule and how much you’ll pay over the life of the mortgage. On one hand it sucks that you’re essentially paying double, on the other hand, real nice not having to have the full 500k upfront.

In 1983 it was 17%.

A high interest rate of one year isn’t going to do much over the course of 30 years.

In 1983 it was 17%.

A high interest rate of one year isn’t going to do much over the course of 30 years.

On error: 1981 was the high point.

one year isn’t going to do much

One year is a short mortgage. Here’s 32 years where the prime rate’s been almost consistently on the hard side of 6. Your parents had excellent jobs before the '80s, but it wasn’t all rosy.

year bank rate prime lending rate 1969 7.46 7.96 1970 7.12 8.17 1971 5.19 6.48 1972 4.75 6 1973 6.12 7.65 1974 8.5 10.75 1975 8.5 9.42 1976 9.29 10.04 1977 7.71 8.5 1978 8.98 9.69 1979 12.1 12.9 1980 12.89 14.25 1981 17.93 19.29 1982 13.96 15.81 1983 9.55 11.17 1984 11.31 12.06 1985 9.65 10.58 1986 9.21 10.52 1987 8.4 9.52 1988 9.69 10.83 1989 12.29 13.33 1990 13.04 14.06 1991 9.03 9.94 1992 6.78 7.48 1993 5.09 5.94 1994 5.77 6.88 1995 7.31 8.65 1996 4.53 6.06 1997 3.52 4.96 1998 5.1 6.6 1999 4.92 6.44 2000 5.77 7.27 2001 4.31 5.81 And 17% on 95,000 isnt an extra 500,000