- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

The economy is fine! We just have… money dysmorphia. /s

The gaslighting is at warp speed now.

Gaslighting? Did you read the article? It doesn’t say that the economy is fine. It’s about how social media makes people feel shitty about how much money they (don’t) have, because they see so many people living glamorous lives online.

Roughly 43% of Gen Z and 41% of millennials struggle with comparisons to others and feel behind financially

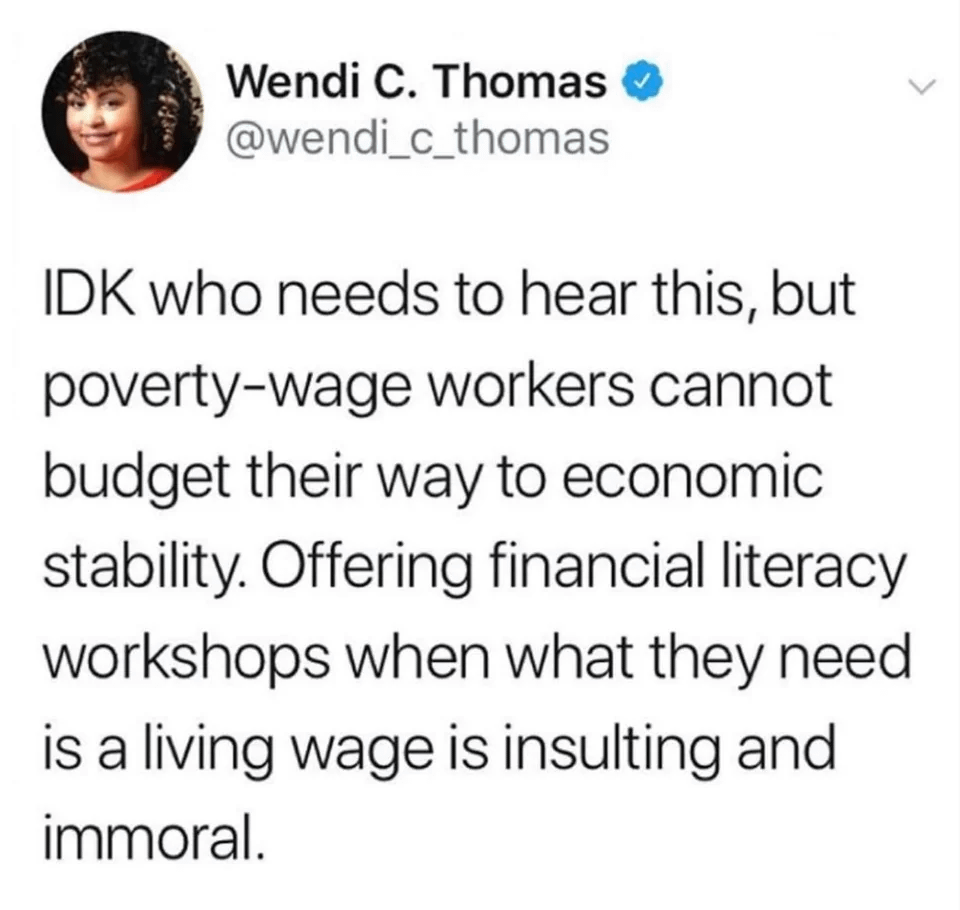

This is the kind of attribution they are making, that its just a psychological condition and not an actual endemic issue that needs to be addressed.

I can definitely see why the term “gaslighting” was used

“Sir, 50% of the population has this virus called COVID.”

“It’s just a virology condition and not an actual endemic issue that needs to be addressed.”

This is a muddled message. Are we caught up chasing an illusion, or are we just more acutely aware of our poor condition?

It reads like it is saying the former, but then quotes statistics that reflect real loss of buying power. On the coasts 100k is no longer a large income. People really do live paycheck to paycheck while carefully managing their spending.

I’m inclined to at least partially acknowledge the gaslighting comment as plausible.

Only 14% of Americans consider themselves wealthy

Only 14%? I’m shocked it’s that high!

I thought “Wealthy” was when the passive income of the money you already have, pays more than you typically spend.

Basically when you can “Live off the interest alone.”I count myself blessed for having earlier made the realization that I value financial security way more than the shiny new thing. What I also realized that often it’s not the shiny new thing where all my money goes to but it’s the repeating expenses from that daily starbucks coffee to groceries and utilities. If you find a way to save there it’ll start accumulating quickly.

That’s a big if.

A huge percentage of Americans (my family included) live paycheck-to-paycheck. There’s little or nothing left to save. They have everything from student loans to medical debts.

Criticizing someone for spending a few dollars a day on coffee to make their life a little more bearable is placing the criticism on the wrong party. You should be angry that anyone should have to make such unnecessary sacrifices. You should be angry that we can’t all get the shiny new thing if we want it.

In fact, more than half of Americans earning more than $100,000 a year say they live paycheck to paycheck, another report by LendingClub found.

I think it’d be interesting to see what would happen if some states had personal finance classes in their curriculum and some didn’t, see if there is a measurable impact down the line.

Well, my own observation shows me that most people don’t know the first thing about basic finances: compounding interest, budgeting, critical thinking when seeing advertisements, and the cost of take-out vs making dinner are some examples.

For gods sakes, check your credit card and bank balances once in a while!. smh.