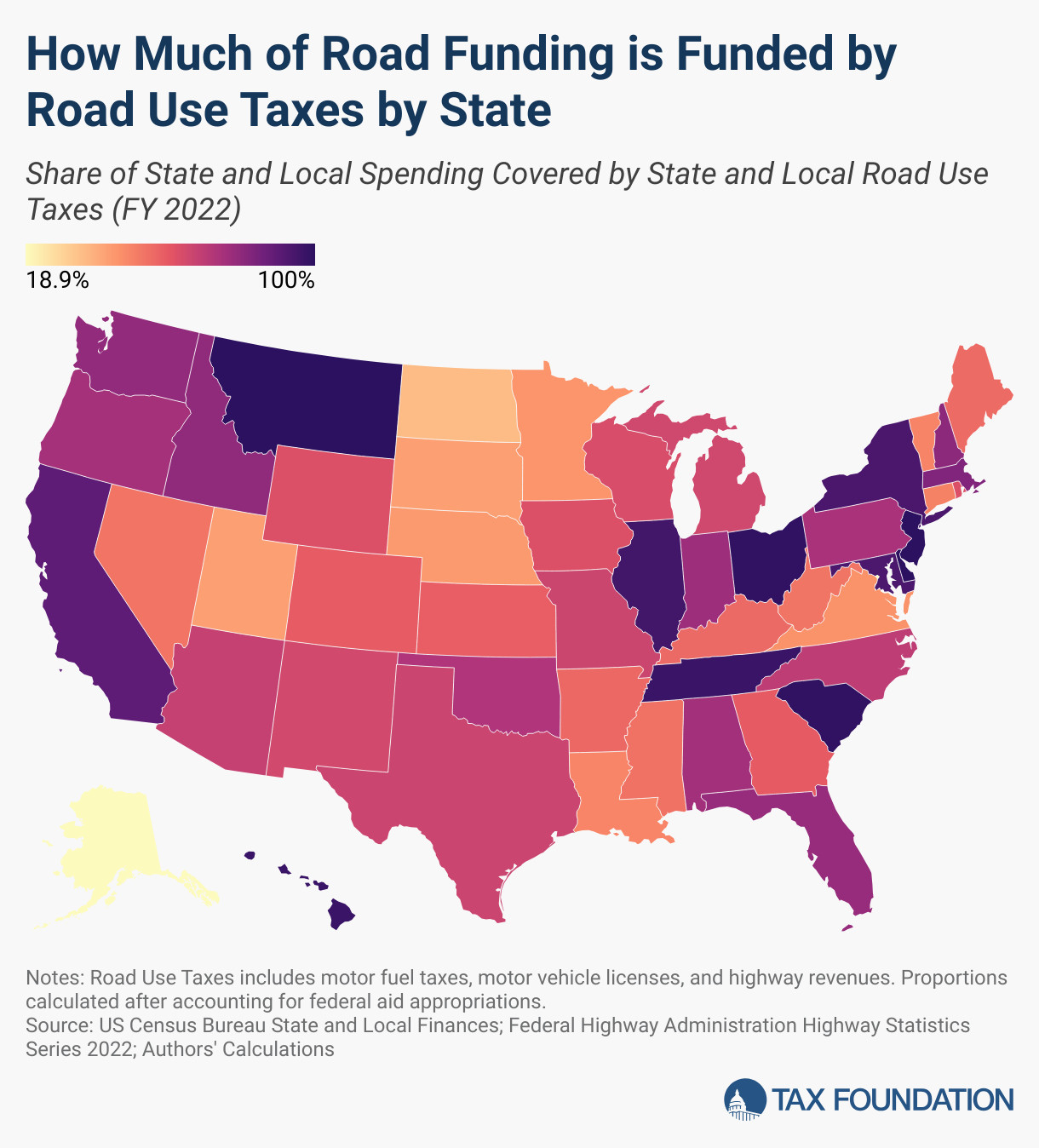

Only 3 states Delaware, Montana, and New Jersey raise enough revenue from cars to fully cover their highway spending.

The remaining 47 states and the District of Columbia must make up the difference with tax revenues from other sources

By diverting general funds to roadway spending, the burden of paying for the roads falls on all taxpayers, including people who drive very little or may not drive at all.

Source: https://taxfoundation.org/data/all/state/state-road-taxes-funding/

That’s how taxes work. Is it also insane people who don’t go to school or have kids have their taxes funding their local districts and community colleges?

Not the same, though.

The ROI on public education should be incentive enough to want your taxes going to it.

Encourageing car dependency creates losses across numerous categories, including health, environmental, further tax burden, public safety, land use, etc.

But my point was that the entitlement that some drivers have about “owning the road” is so toxic.