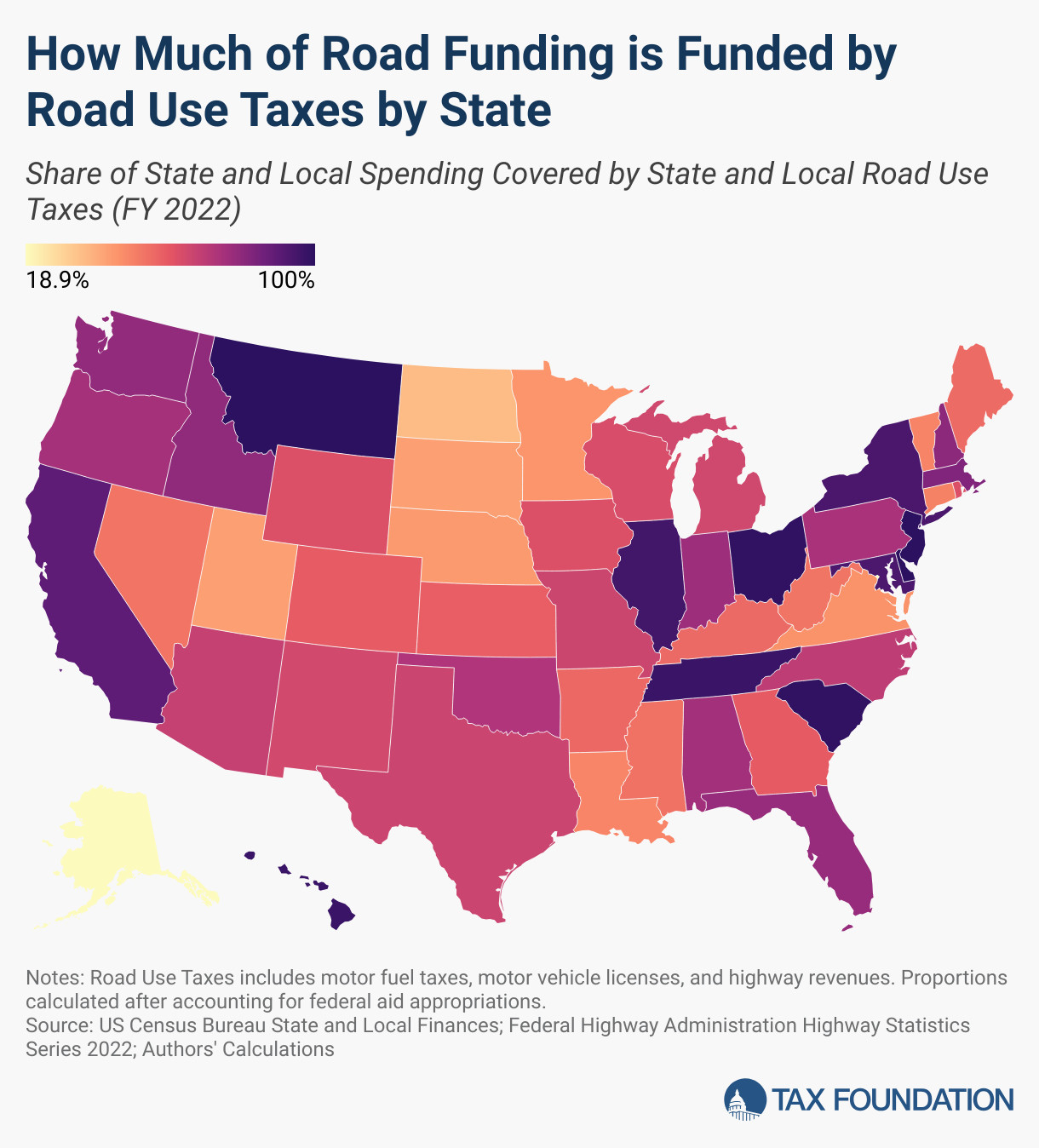

Only 3 states Delaware, Montana, and New Jersey raise enough revenue from cars to fully cover their highway spending.

The remaining 47 states and the District of Columbia must make up the difference with tax revenues from other sources

By diverting general funds to roadway spending, the burden of paying for the roads falls on all taxpayers, including people who drive very little or may not drive at all.

Source: https://taxfoundation.org/data/all/state/state-road-taxes-funding/

We should be paying for the trucks to use the roads when we buy products transported on the roads. Just like how we pay for the ships, ports, trains, and railroads used to transport other goods. The cost of transport should be part of the total product cost. Trucks should be paying road tax in proportion to the damage they do to the roads, and those costs should be passed to their customers, then to us. This is how it works with most other forms of transport.

By moving the cost of the roads used by trucks to “everyone”, it makes trucking artificially cheaper and turns the cost of roads into an externality. If shippers had to pay those costs directly, I bet there would be many more goods shipped in more efficient ways.