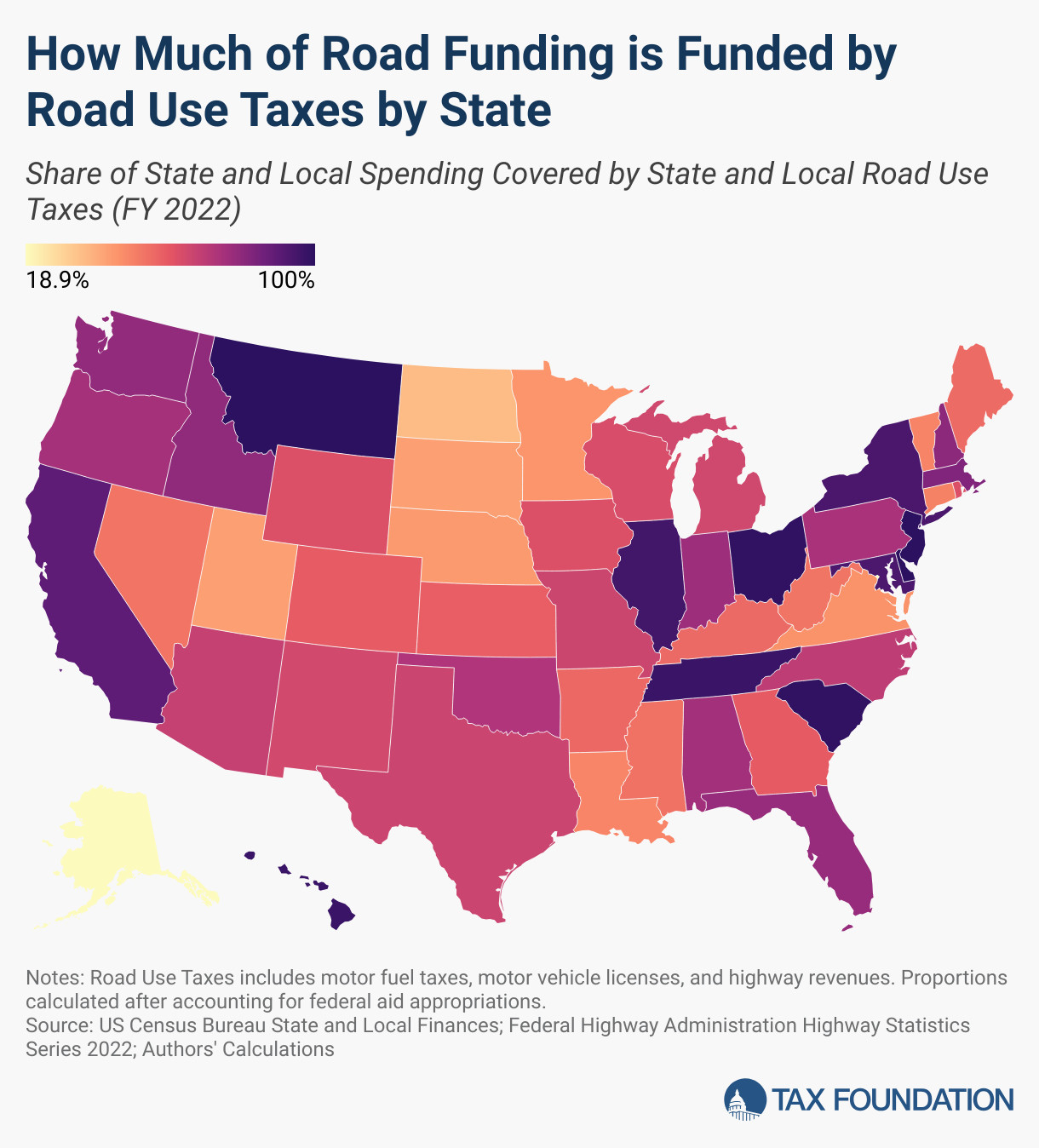

Only 3 states Delaware, Montana, and New Jersey raise enough revenue from cars to fully cover their highway spending.

The remaining 47 states and the District of Columbia must make up the difference with tax revenues from other sources

By diverting general funds to roadway spending, the burden of paying for the roads falls on all taxpayers, including people who drive very little or may not drive at all.

Source: https://taxfoundation.org/data/all/state/state-road-taxes-funding/

This map cannot be correct. For example, it shows California drivers paying much of the costs of their highways and that is not the case at all.

I don’t doubt it, but how do you know? Can you share a contradictory source?

https://www.lao.ca.gov/reports/2023/4821/ZEV-Impacts-on-Transportation-121323.pdf