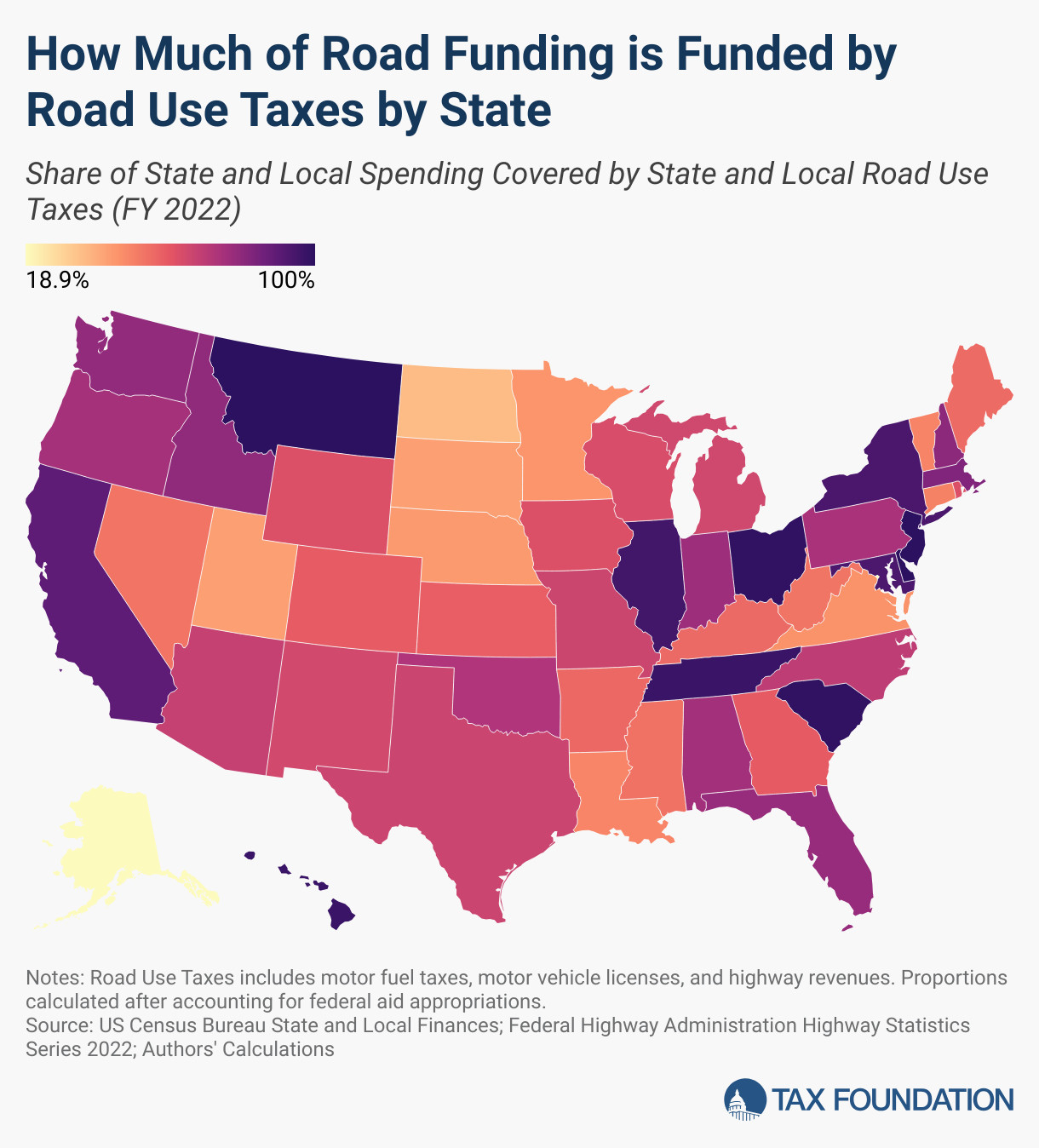

Only 3 states Delaware, Montana, and New Jersey raise enough revenue from cars to fully cover their highway spending.

The remaining 47 states and the District of Columbia must make up the difference with tax revenues from other sources

By diverting general funds to roadway spending, the burden of paying for the roads falls on all taxpayers, including people who drive very little or may not drive at all.

Source: https://taxfoundation.org/data/all/state/state-road-taxes-funding/

I will probably get down voted because this is fuckcars. But For Ohio, The vast majority of these taxes for road funds come from fuel taxes and motor registration fees. Some come from property taxes, which I think is reasonable seeing as they have roads that go right to their houses.

This seems ok to me. People who use vehicles end up paying for the roads they rely on.

And those who don’t have cars still get access to the roads.

Do you have a source for those numbers? Id be surprised if the fuel +registration taxes cover even 1/3 of the cost of roads. Maybe they could cover basic maintaince like painting, plowing, and potholes, but initial construction or resurfacing likely needs heavy investment from elsewhere

Edit: i see the OP does have a source for tax revenue numbers, but it is unclear exactly what is covered under the taxes. Does it include funds for police for traffic enforcement? Funding for emergency services responding to accidents? The site isn’t clear if new road construction or lane widening is included in the budgets as road maintaince or not.

According to the map, Ohio is one of the outliers.