What makes high-end philanthropy different from low-end philanthropy?

When you donate something to a charity (money or physical objects) do you then get to keep using the money or objects? No, you no longer have them in your possession - you have relinquished control of it.

The rich set up foundations called a Donor-advised fund

It is: a public charity, where an individual can make a charitable gift to enjoy an immediate tax benefit and retain advisory privileges to disburse charitable gifts over time.

Ask yourself why every single billionaire starts his or her own charity instead of giving to the thousands that already exist. Because once it is gifted like that it no longer belongs to them. They are literally donating money to themselves and avoiding taxes.

This is the last time I will respond to you - you simply are not understanding.

They are not giving away the money the same way as you or I do when we donate to charity.

They give the money to themselves!!!

The foundation is in their name and they are in charge of how that money gets used.

Money is power and influence. They can do a lot with that money.

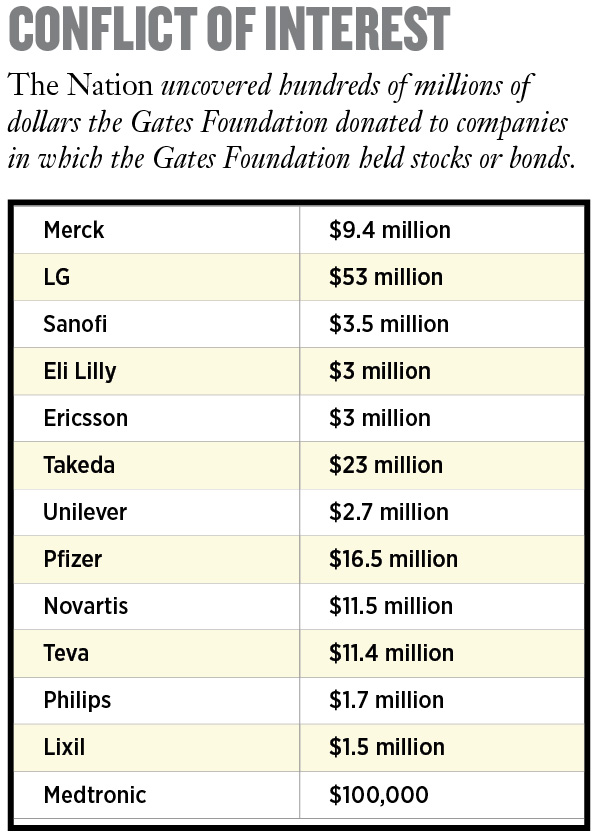

Look at that infographic I posted above as a reply to another commenter.

Bill Gates uses his foundation to donate to companies that benefit his existing stock investments.

https://www.thenation.com/article/society/bill-gates-foundation-philanthropy/

If it’s super important for you to have the last word and you wish to respond, go for it.

I am not going to reply to you anymore because you are failing to understand.