Doctors say insurers are automatically downgrading their claims and paying less. Insurers say it’s their duty to prevent overbilling.

The practice of automatic downcoding seems to have taken off in the last few years, as health care costs soar and insurance companies use third party vendors and AI programs to reduce costs.

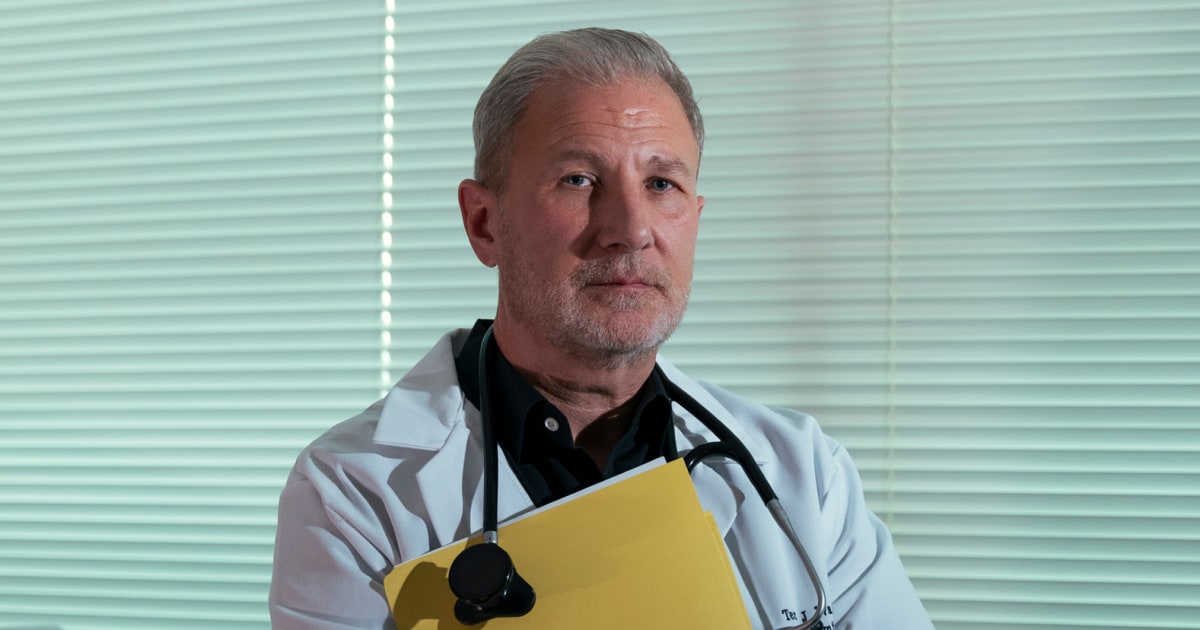

NBC News spoke to doctors’ offices across numerous specialties from around the country, all of whom rely heavily on office visits — rather than surgeries and procedures — for their revenue, and all of whom are experiencing downcoding from insurers.

The problem, doctors say, is that lower and lower reimbursements mean reliable community doctors, like Wagner, could have to make choices that are inherently bad for patients, like cramming more patient visits into a single day to make up for lost revenue, dropping patients on certain insurance plans, or selling their practices altogether.

Not to mention the cost for license, malpractice, and billing agents. Also, remember that the insurance companies end up actually paying between 50 and 70% of claims so so for every paid 200 dollar claim there may be one that is done “for free” since it will never be paid. It gets averaged out to be much less.

There is literally an army of people employed on both ends to just argue about these things. That’s where our healthcare dollars go.