- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

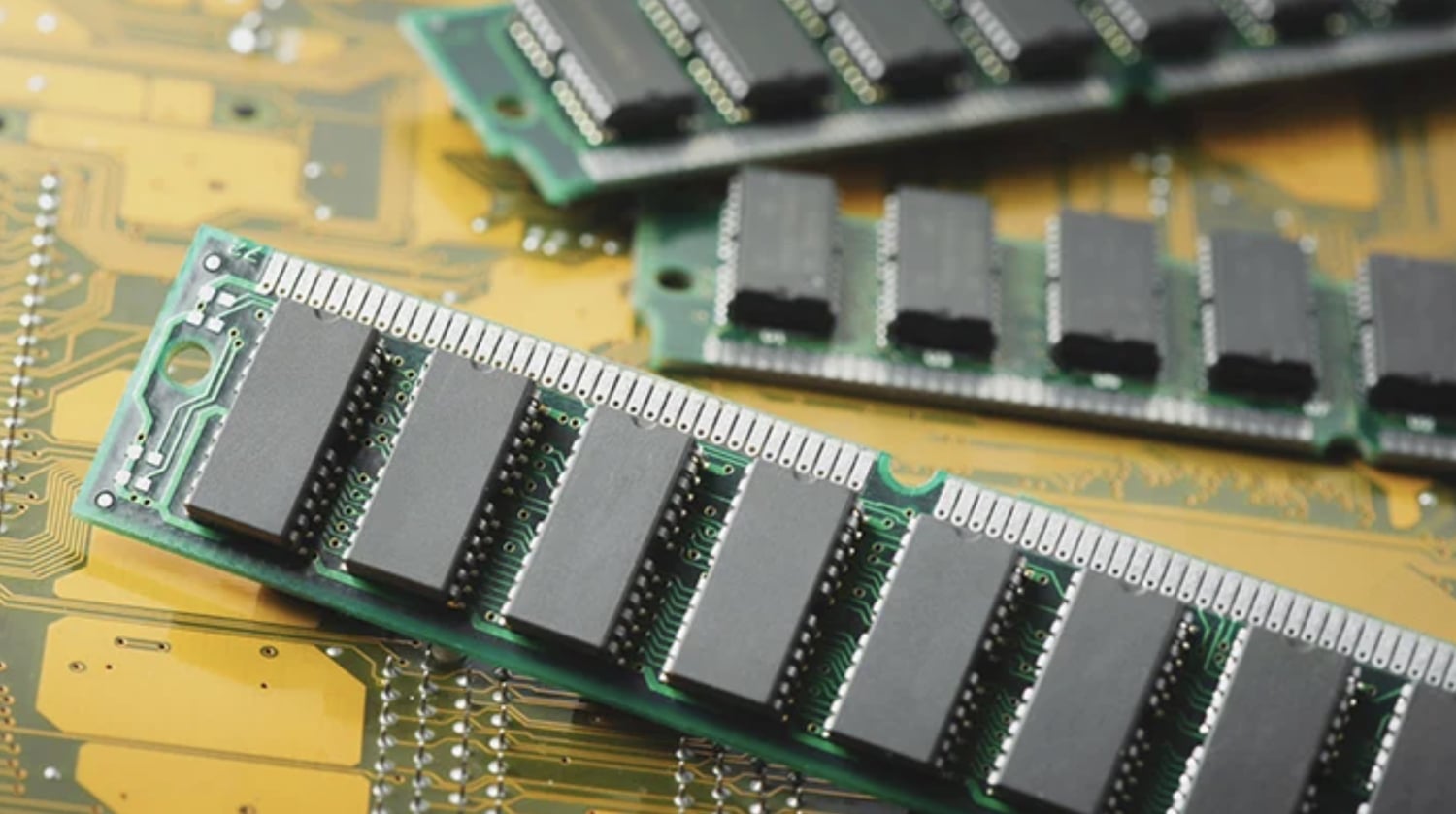

What I heard on the ground floor from various system integrators, components manufacturers, and other companies, is memory supply has been tied up for all of 2026, and that shortages could last as long as until 2031.

Sure it’s scuttlebutt but wouldn’t surprise me as being true.

Memory that doesn’t exist yet has been bought with money that may never exist to supply datacentres that haven’t been built to serve demand that isn’t there.

The solution is surprisingly simple:

“Sorry, I can’t use your online services. My electronics died. Oh well.” 🤷♂️

Or we hunt them down

So be it, then… We ride at dawn.

A 5 year DRAM shortage is pretty hard to imagine. I have to suspect that’s a projection that assumes no AI bubble popping (which given how insanely over-leveraged basically every company involved in the bubble is, its inevitable. They’re literally spending more building these datacenters than they can ever dream of recouping once built!) The last DRAM shortage (around 2017-2019 by memory) was only really bad for about a year or so, getting gradually better until it became an absolute glut of DRAM supply that lasted until…well about 3 months ago. $60 per terabyte of SSD storage was glorious, and hopefully I can afford to benefit from the next DRAM glut in 2-5 years

Saw this in the news. They’re trying really hard to stack the federal reserve board and send interest rates back down to financial crisis/pandemic levels. AI bubble can have some leg room if interest rates tank

Honestly interest rates dropping might be ultimately be a good thing. The job market is so tight and most recession indicators have already been blazing. I doubt they’ll do the same hard drop they did in Q2 of 2020, but I do think more aggressive rate cuts might alleviate a lot of the burden consumers (especially young adults and anyone unfortunate enough to have been/be jobless over the last couple of years) have been feeling. A big chunk of the inflation consumers were seeing on goods in 2024 was just companies making opportunistic price increases, as evidenced by the heavily advertised price drops afterwards.

Additionally there is the statistic that nearly 50% of all retail spending in the United States is made by the top 10% of earners which is a heck of a dangerous tightrope for the economy. I do think that’s the other shoe waiting to drop right this second. If the wealthier Americans get spooked and start to pull back their spending this economy is going to tumble

The AI bubble will pop long before then, and everyone will have more RAM and GPUs than they know what to do with.

looks at housing bubble “… god i hope you’re right”

As much as private equity wants to think it is, housing is not a commodity like DRAM is.

Housing always has a base value in that people always need places to live, so it’s price is sticky. The need for DRAM could disappear overnight if it so happened that way.

For the dram unfortunately won’t be possible to use it in the consumer space, at least not in the current form. Hbm is really server stuff, and as is, you cannot repurpose it. As for the GPUs, maybe they can be used for the consumer space but I am not entirely sure the specs would be wise to use it at home, since they need some very serious cooling capabilities, as well electricity consumption. Biggest winners of this pop in my opinion would be anyone who need cheap server rack stuff.

The RAM for 2026-2031 hasn’t been produced. It’s the production capacity that’s been bought out.

If the AI bubble bursts, the manufacturing can be reassigned.

Part of it is not finished DRAM that was sold yet, it’s wafer capacity at the factory.

Sam Altman has promised orders for a kazillion wafers that don’t exist yet. It’s been argued this is less legitimate demand and more an effort to crimp the scaling ambitions of other competitors.

If his cheque bounces early on, the manufacturers are likely to reassign his slots to other buyers.

The manufacturers are taking a fair bit of risk though. If they aren’t getting paid before work starts, and the bubble pops in the middle, thry could end up with a lot of (partially or fully) finished wafers that they can’t just slice up and sell to Corsair and G.Skill.

You are not wrong about the reallocation part. However, if you see the actions from micron (fuck you micron BTW), they are going all in and having a shit storm in PR on the consumer side. If they are taking these risks without proper assurances, then they are utterly deranged

Hbm is really server stuff, and as is, you cannot repurpose it

I mean, you and I can’t, but memory manufacturers? They’ll find a way.

I hope so, but there’s a way that bubble doesn’t burst even if we’re right that AI never delivers competent/competitive quality: that monopolies simultaneously integrate AI into their products and the entire world simply gets worse, while consumers pay extra for those very AI features they don’t want and which produce an inferior product.

Even that isn’t going to be enough. OpenAI has to start making payments on some (most) of these deals and startups starting this fall. If they don’t make these payments (it’s mathematically impossible for them to do so) then everything gets wiped out and the bubble pops.

Pro tip to all you investors here, if your hot new thing can’t do anything other than net360 terms and has double-pledged collateral, it’s not a good investment.

As far as it being like the dotcom crash, at least the few companies that were actually viable and legitimate survived and it “separated the wheat from the chaff” or something along those lines.

There is no viable AI company here, and the market will quickly find out that there isn’t even chaff to be found here, it’s mostly floor sweepings of post processed MDF sawdust and dirt.

I suspect very creative firms of accountants and CFOs are working hard right this moment to identify the next step in the shell game. So I suspect some creative refinance could avoid that outcome. But I definitely hope you’re right.

Oh no it’s far worse than that. Private equity is heavily invested into data centers, and so are most large international banks. Private equity is playing the fun “volatility laundering” game where they are deliberately not reevaluating assets to make them look like they are worth more on paper than they actually are. They are basically saying this

assethouse is still worth the $50,000,000 it was valued at 5 years ago, never mind the fact it burned down and is now a superfund site and uninhabitable.International banks are also issuing loans based solely on “just trust us bro” paperwork, using the AI companies paperwork as gospel and not looking at anything other than what they are presented with. The average cost of renting a Blackwell CPU is now $4.41 an hour, and that’s before the vast majority of these data centers have even come online.

Something something supply and and demand just trust us tho.

Currently, with data from all AI compute companies and services COMBINED in 2025, revenue comes out to 0.5831% of expenditures.

So for every $1,000,000 spent, you will make $5,831.

The only way out of this mess is if the banks either get paid back for their loans (see previous figures) or private equity gets a lot more capital… and starts paying back banks again (see previous figures comment about previous figures)

As an additional note if I am right and this bubble pops (if a single startup goes under, literally any one) then it’s pretty much the collapse of the global financial system and an economic crisis at the level that the world has never seen before.

Literally, and I cannot stress this enough, the entire current system is built on the belief/sentence/mantra “number go up” with no regard for literally anything else.

Well, great. So looking at 2008 for the most recent model, I suppose that means government bailouts or subsidies using taxpayer money to save the companies and thereby prevent a complete collapse of markets?

Kind of? Except the lenders with the largest amounts of loans in order are: 1.Blue Owl (USA) (remember this company, it’ll be important as a canary probably) 2. Mitsubishi UFJ financial group (Japan) 3. JP Morgan Chase (USA) 4. Deutsch Bank (Germany) 5. BnP Paribas (France) 6. Morgan Stanley (USA) 7. Sumitomo Mitsui Banking Corporation (Japan)

So kinda like 2008 but you need (at the very least) Japan, Germany, France, the USA, and possibly South Korea to all coordinate and do bailouts cooperatively together to maybe have a chance.

Good thing we haven’t pissed off our allies or disrupted trade in general, and we also haven’t fucked with interest rates or bonds or anything so we have plenty of tools in our arsenal (god help us all, puts on all of our collective livers.)

There is no saving the AI companies because it is mathematically impossible for them to make money. You would have better luck investing in your local meth heads trying to make alchemy real using nothing but books published by Wizards of the Coast.

What way is that?

This cyber enron circlejerk wont last that long

The market can remain irrational longer than you can remain solvent.

Oh no, I saw this coming and bought RAM at the first hike. I’m good for 8 more years. This doesnt help everyone else tho.

Totally stealing Cyber Enron

This is for one purpose if it’s true: To force consumers to rent everything, including their computer, so they can be surveilled.

Don’t use GeForce NOW, even if there’s a Linux client in the works, because it’s surveilled too.

Surveillance isn’t the reason, it’s a larger and more consistent profit margin.

I’m sorry, the game streaming platform can’t be bothered to make a client for Linux??

They do and have for a while.

Just not gonna buy any new games then.

Get caught up on that game queue.

Fortunately I’m currently I’m happy with what I have. I think I’ll oulast this.

I thought the same until one ram stick died this week, it’s apparently now $1200 for a replacement

JFC, what size? I paid about that for 64gb kit, and between my purchase and pickup 3 days later it went up like 150 - 200

Ouch. Never had memory fail on me before *fingers crossed.

I wouldn’t be surprised to see some foundries retooling to produce DRAM in less than five years.

Thank god I never sold my old desktops.

I have a i5-3470 with 16gb, i7-8700 with 16 gb, a steamdeck, and recently bought an m4 air.

I’m only gaming on the steamdeck, and those other computers are used for home server stuff.

My old computer is 16gb DDR-3, as I used it long time before jumping over to 32gb DDR-5 based systems. And thanks to consoles and rising handhelds (first gen Steam Deck <3), 16gb will be still the base floor for long time it seems.

I really hope tha devs target the steamdeck as a baseline for all future games.

I love it when they have a steamdeck graphics profile too.

The only problem is the current most used AAA game engine Unreal Engine 5. It is not very good for low end hardware, as the system and developers struggle to optimize it. Even the best devs struggle. But they can’t afford to require high end or just mid PCs. Handhelds become quite popular now. Devs want to make games run on Switch 2, which is beneficial as whole because it has to run under constraints of the system and environment.

Given that RAM prices may stay this expensive, my prediction is that developers absolutely have to make their games run on less powerful hardware (and on 16gb). I wonder how the Steam Machine (PC from Valve) will impact developers focus on Steam Deck.

In 5 years china is going to ramp up their domestic production, so they’ll have cheap RAM while we don’t

They’ll sell it.

Why would they sell it for cheap, if they can sell it for just a little but under current market value and maximize the profit? People would buy it, if it is the cheapest option. Which does not mean it will be cheap overall, if its constantly sold out.