We need some massive breakthroughs in AI efficiency soon or we’re going to literally run out of RAM manufacturing capacity for all the things. The situation is so bad that in no time at all you’re likely to be put on a six-month waiting list to buy a new PC/laptop or mobile phone.

How long do you think this bubble can last realistically? I give it another year tops given that we’re already seeing bubble discussion entering mainstream media. That’s a clear sign that we’ve now reached the peak, and that investors are starting to get cold feet. Given that the whole thing runs on free money, investors losing confidence is going to mean the whole house of cards will start coming down.

I doubt the bubble will burst because of logistical issues. There’s money to be made. More manufacturing and fabrication will be built. Scarcity pressures drive capitalist incentives and novel technologies will be built and investments will be made.

The bubble bursting will be from the total lack of value contributed to the economy by the a.i. projects. This will effect tech stocks, which dominate the stock market. However, if this process releases capital reserves into the economy it will have the effect of creating more consumer spending and there will be a counter balancing effect.

The real problem is ultimately that there aren’t enough jobs being created by all this activity to counteract all the job loss that’s happening. This can be papered over for a little while by having higher than average salaries being created as part of chasing this bubble, but that won’t last too long.

In the end, the bubble bursting will a financial event, not a social one. Many people will get financially hurt. Many institutions will get bailed out. These things are all merely the sharpening of contradictions. The bubble bursting will not cause a collapse directly. It’s when the contradictions become unsustainable that the collapse happens. It’s possible this financial event will push contradictions past that point, but it is impossible to tell.

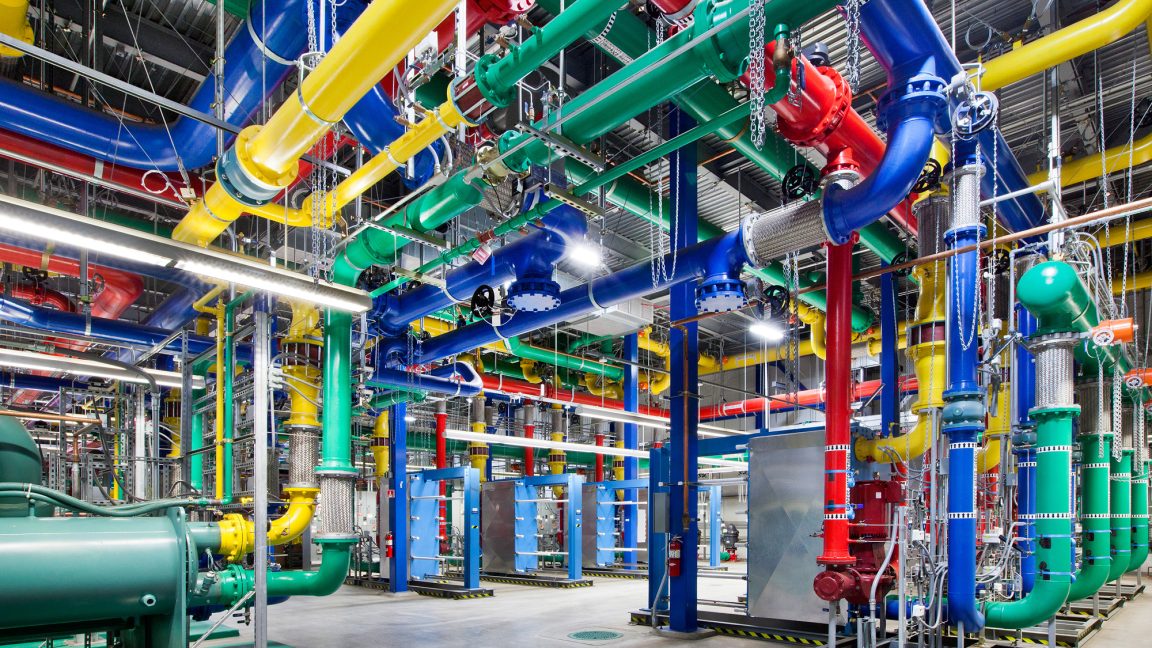

I agree there will be a significant social aspect to the bubble popping, but logistics issues are absolutely play a big role here as well. Just looks at the energy production picture in the US, and the fact that rare earths are already running low because China is increasingly using them domestically meaning there’s not enough left to export. These two factors alone mean that it’s physically impossible to actually construct and operate of all the new data centers the US is planning. All these data center investments are basically fiction.

Meanwhile, even the profits themselves are fictitious because it’s just seven companies writing IOU notes to each other. That’s literally the whole AI market right now. The hype is absolutely insane at the moment with companies burning through billions without any clear path to profitability, and we’ve got startups raising $2 billion seed rounds without even explaining what they’re building. That’s peak dotCom madness right there.

What’s different this time around though is the scale of this thing. We’re talking about $400 billion in AI infrastructure spending this year alone, which is like funding a new Apollo program every 10 months. But the revenue is basically pocket change compared to the spending.

The reality check is already happening though. GPT-5 was a massive disappointment, 95% of corporate AI projects are failing to deliver returns, and nobody has shown a clear path to actual sustained revenue. Meanwhile the big tech companies are using various accounting tricks to hide how much they’re actually spending on this stuff.

And a huge chunk of the US economy is now tied to this AI spending. Investments in data centers that will never be built are literally driving GDP growth, which means when this thing pops, it’s going to hurt way beyond just Silicon Valley. The whole house of cards is propped up by this idea that AI will at some point pay for itself, but the math just doesn’t add up. These companies need to generate something like $2 trillion in AI revenue by 2030 to even break even on all this capex, and right now, they’re nowhere close. OpenAI alone is burning through cash like it’s going out of style, raising billions every few months while losing money hand over fist.

I expect that once it’s finally acknowledged that the US is in a recession, that’s finally going to sober people up and make investors more cautious. The VCs who were happily writing checks based on vibes and potential will start demanding to see actual earnings, and that easy money environment that’s been fuelling this whole boom is going to vanish overnight.

If a few big institutional investors get spooked and start quietly exiting their positions, it could trigger a full blown market panic. At that point, we’ll see a classic death spiral. The companies that have been living on investor faith, with no real path to profitability, are going to run out of cash and hit the wall leading to an extinction level event in the AI ecosystem.

When that all actually starts happening ultimately depends on how long big investors are willing to keep pouring billions into these companies without seeing any return. I can see at least another year before reality starts setting in, and people realize that they’re never getting their money back.

So I think there’s a few things you’re missing.

-

There are MASSIVE capital reserves in the US right now. Something like $2 trillion in dry powder. This is what it means to be in recession - money stopped moving and went into a reserve. So even though a lot of the economic activity you see is just pump and dump schemes in the market, the money is still there. Microsoft has enough cash reserves to operate with zero revenue for the next 80 years, last I checked.

-

Keynesian interventions work, at least temporarily. The reason this is important is because Keynes would have the US govt borrow money from the owning class to get money flowing again. But if you the govt can get the capital owners to deploy their reserves, is serves much the same function as a Keynesian intervention without the sharpening effect of th debt - even if the end result is a bunch of half-finished data centers, the money will be circulating in the economy again. This may be the real reason behind Trump’s meetings with the tech firms demanding they pledge a certain amount of money to building things - literally shakedown Keynesianism.

-

When you release those capital reserves, suddenly switching costs become acceptable, startup costs become acceptable. That means that despite supply chain constraints, the demand will be high enough for expensive innovations to be undertaken and more expensive fuels to be used. Hydrogen is getting a boost now, as an example. Will it be enough to meet demand? No. But it will have an uplifting effect on the productive economy broadly, which will lessen the blow of a popped bubble.

-

The labor discount is growing. With all of this job market contraction, wages are coming down. And no just in the marginalized communities - this administration’s approach has been universal in putting downward pressure on the entire working class. That’s going to put downward pressure on costs, which will inflate profits, and also create room for competition to put downward pressure on prices eventually. It also means more people could be hired for the same dollar. The fact that all of these layoffs are pretending to be caused by a.i. means that when the a.i. narrative bubble bursts, there will be a narrative continuity with hiring more people again.

Can all of this fix the core problems? No. But my point is that there is a lot of space between the bubble bursting and the collapse of the system writ large, with plenty of mechanisms already in the works for softening the blow.

The real question is whether the contradictions will overwhelm their containers or not. There will undoubtedly be unrest - we are seeing labor movements growing and working class consciousness on the rise. We know what happens after that - violent disruption. Is this the generation where the military policing of citizens fails? Or are we in for yet another cycle of uprise, repress, recover, rebuild?

Your dry powder argument relies on a misunderstanding of liquidity versus solvency because capital reserves mean nothing if the investors controlling them decide the party is over. The moment VCs stop looking at projected growth and start demanding to see actual earnings is the moment the easy money fueling this boom vanishes overnight. Microsoft might have the reserves to idle for decades but the thousands of startups built on top of their infrastructure do not. When the hype clears and the balance sheets show that these AI projects contribute a total lack of value to the economy the capital is not going to circulate for the sake of the public good. It is going to flee to safety.

Furthermore, the idea that Microsoft shareholders will just politely applaud while Satya Nadella incinerates their dividend payments on data centers that don’t generate profit is pure fantasy. You have to understand that institutional investors have zero loyalty to the mission of artificial intelligence. They are loyal to one thing which is the quarterly earnings report. The moment that cash burn starts threatening the stock price or the dividend, those massive capital reserves you mentioned effectively belong to nobody because the shareholders will initiate a capital strike.

Microsoft is a vehicle for wealth extraction, not some charity for scientific advancement. If the board decides to burn $50 billion a quarter on compute clusters with no clear path to monetization, the major funds like BlackRock and Vanguard are not going to wait for the long term payoff. They have a fiduciary duty to not lose money. They will dump the stock, the valuation will crash, and the board will be forced to kill those AI projects immediately to stop the bleeding. The reserves argument ignores that a company’s survival isn’t just about cash in the bank, it’s about stock valuation. If the stock tanks because investors flee, the company loses its ability to raise capital, hire talent, or acquire smaller companies. The liquidity dries up because the market cap creates a death spiral that makes spending that cash politically impossible for the CEO.

We are already seeing the early tremors of this. Look at how the market punishes these tech giants every time they announce a higher capex without a corresponding jump in immediate revenue. The smart money knows that this is a game of musical chairs. They are currently tolerating the spend because of the hype, but they are watching the exit doors like hawks. The second the narrative shifts from investment in the future to wasteful spending, that 2 trillion dollars in dry powder is going to be pulled out of the tech sector faster than you can blink, leaving the workers and the broader economy to hold the bag.

You also cannot paper over the logistical reality with Keynesian interventions or government shakedowns because we are hitting a hard physical ceiling with energy and chip fabrication that money simply cannot fix fast enough to satisfy quarterly reports. Even if the state tries to force capital deployment it will result in a market revolt because investors will not tolerate burning cash on half finished data centers that cannot be powered. Innovation in energy sources like hydrogen takes years to bring online while market panic takes minutes. Once a few big institutional players get spooked by the lack of ROI and start quietly exiting their positions it will trigger a panic that no amount of government posturing or available capital can stop.

A pivot back to cheap labor just because wages are down isn’t a solution either. The companies creating the bubble are living entirely on investor faith with no real path to profitability. When that faith breaks they do not switch to hiring humans they just go bankrupt. The collapse happens when the contradiction between massive valuations and zero actual earnings becomes unsustainable.

Whether the crash will lead to organized militant labour or not ultimately depends on how many people end up getting pushed off the cliff this time around. After 2008 crash, millions of people lost everything, but there was still a critical mass of people who were able to put their lives back together and that allowed the economy to return to a sense of normalcy. However, this time around people are on far thinner margins, and it might not be possible to patch things up going forward. I suspect we’ll see how this all plays out sooner than later.

All great points, but have you considered a National Counsel of Corporations?

The problems you raise have been solved before. The state takes over the management of the companies in order to keep the markets happy. It helps that 80% of the stock market is owned by one single bloc (https://welcometothemachine.co/)

Yes we are absolutely running up against physical limits, but again, that just means more innovation is going to be done. Sure hydrogen takes a lot to bring online, but Microsoft alone could probably fund bringing that fuel source online in a big way. To you point, they won’t because they aren’t saviors, but it’s not too far fetched to imagine the USG forcing companies to contribute to a strategic energy fund.

What’s happening right now is that people are building natural gas power plants on campus with the data centers. I can imagine coal plants coming back for the purpose.

Of course it will all run up against chip scarcity.

I think we’ve got at least 2 years before any one particular scarcity becomes a pin prick to the bubble. I think it’ll take 3 years at least given the current state of play, and in those 3 years a lot can change.

And as for profit, the USG is probably doing a lot of Keynesianisms right now paying defense companies to develop strategic artificial intelligence, so all of the startups going nowhere isn’t necessarily the bellwether of pin prick.

Also, I wasn’t saying that downward wage pressure would create the conditions for the same people to be rehired by the same companies for the same positions. I was just saying that downward wage pressure creates new economic opportunities for margins. In essence, downward wage pressure at scale creates upward pressure on the rate of profit. Certain labor jobs may become more viable if wages continue to fall. And we’ll need labor since clearly the US is way behind on factory automation.

I think China can keep labor prices low enough to make this difficult or impossible for the US. But that’s why the US keeps trying to decouple. In the meantime, I imagine the US will start doing a lot more exploitation of low wage labor in Latin America. But then, factories just can’t be built fast enough.

I think potentially what I am pointing to is that the USA might be 2 years away from a total economic collapse and there’s a large faction of the ruling class working to extend that time line via various means.

And the reason I think they are is because there is nowhere else for them to go. The only military potentially stronger than the US is China and China isn’t going to allow EuroBourgeois to setup shop fully in China (unless it’s a nice big trap).

So for better or worse, the owning class has to make it work in the US or it’s all over. And that means every single technique is going to be applied to get another 6 months and another and another.

The National Council of Corporations doesn’t really change anything I said above. The elephant in the room is that this tech is not living up to the expectations, and none of these companies have a viable business model. I mean it’s possible that the whole AI industry will be nationalized I suppose, but I can’t really see that happening myself. Furthermore, even if it did happen that would also lead to a crash because the government would be diverting already strained resources towards propping up an industry that produces no actual value.

There is no way to innovate your way out of this. It’s not a problem you can solve by just throwing money at it. Any serious innovation and infrastructure development is going to be a decades long project. The bubble is going to pop long before that. Again, read my article that I linked earlier. I discuss the specifics of the logistics involved, and it’ obvious there’s nothing that can be done to massively increase grid capacity in a way that would be needed.

Not only is the US behind in factory automation, it’s behind in having actual factories, and the manufacturing has only continued to shrink since Trump took over. There aren’t factories available to employ people, they would have to be built. But building the factories requires investment and skilled labor that itself doesn’t exist. The US economy has been increasingly financialized, and that means you don’t just have a readily available pool of workers to go out and build factories. Even if you did, then you’re still looking at at least a decade of figuring out the supply chains and all the other logistics needed to build and operate them.

Just look at how the attempts to ramp up ammunition production for Ukraine have fared. The US was unable to meaningfully ramp up basic things like artillery shell production, and that’s with state level funding being freely available.

I do think a 2 year timeline is very much a reasonable bet. We will likely see first tremors early next year, and then things will just continue to get worse from there.

In terms of military, it’s pretty clear that Russia is beating the US in Ukraine, and China’s military industrial strength absolutely dwarfs anything Russia can put out. At this point, DPRK likely has a more competent military than the US.

So, the owning class might be scrambling to make things work, but just like with Ukraine, simply wishing for things really hard can’t change material reality.

-

Turns out brute forcing isn’t sustainable

Moore’s Law:

We’ll soon find out how strong and stable that bubble truly is.

“The company faces similar constraints serving its 800 million weekly ChatGPT users, with even paid subscribers regularly hitting usage limits for features like video synthesis and simulated reasoning models.”

Who is paying for this crap?